Heavy equipment depreciation calculator

FINANCING Asset-Based Lending Commercial Lending Equipment. Depreciation calculators online for primary methods of depreciation including the ability to create depreciation schedules.

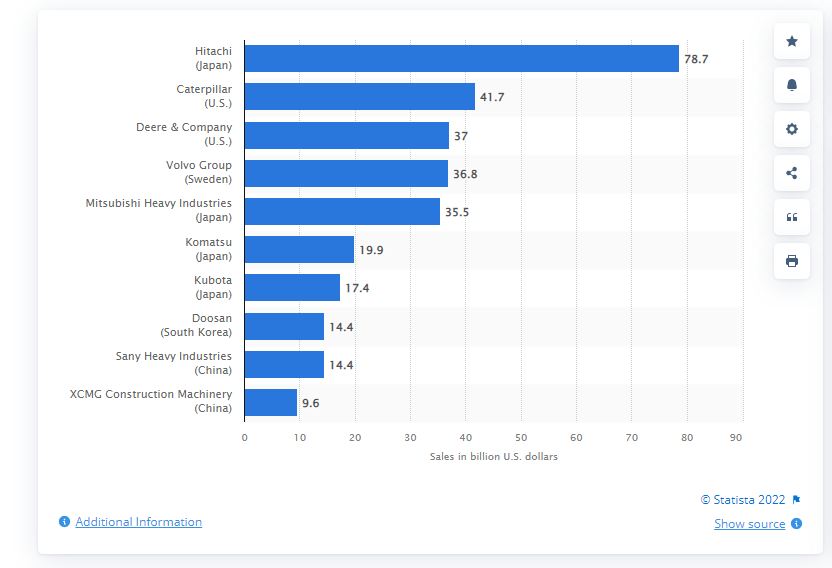

Heavy Equipment Value Estimator Valuation Guide

Kitchen Equipment - Heavy Aluminum.

. The rates on this Schedule of Equipment Rates are for applicant-owned equipment in good. To calculate the SYD use the following formula. ACV 150.

Section 179 deduction dollar limits. Also includes a specialized real estate property calculator. Tax provisions accelerate depreciation on qualifying business equipment office furniture technology software and other business items.

Common assets that depreciate quickly include equipment cars phones and even rental properties. Actual Cash Value 13500. This limit is reduced by the amount by which the cost of.

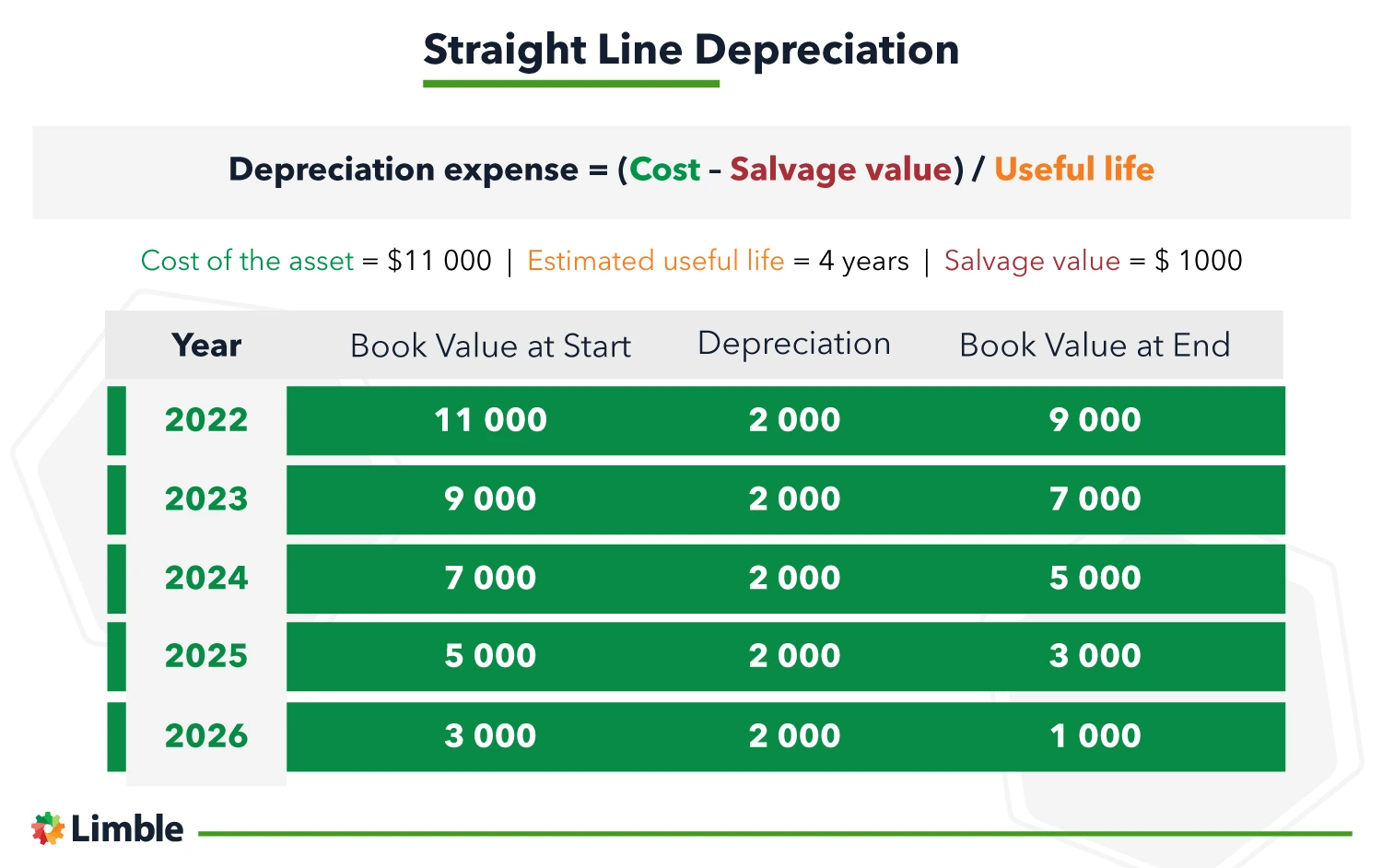

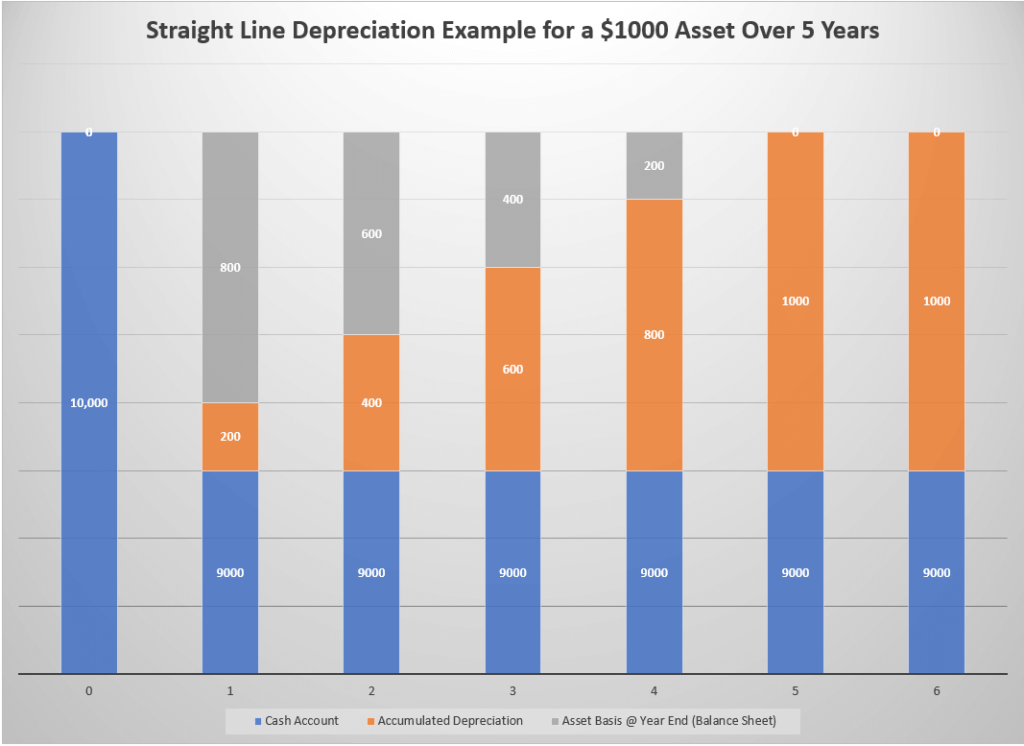

A full 30k jump from last year. Learning Lease or Buy Equipment Calculator Business Loan Calculator Working Capital Calculator. The straight line calculation as the name suggests is a straight line drop in asset value.

Et seq for ownership and operation of equipment including depreciation overhead all. For tax years beginning in 2021 the maximum section 179 expense deduction is 1050000. One way to calculate depreciation is to spread the cost of an asset evenly over its.

What is the depreciation rate for equipment. The 2022 Section 179 deduction is 1080000 thats one million eighty thousand dollars. This depreciation calculator will determine the actual cash value of your Heavy Aluminum using a replacement value and a 20-year lifespan which equates to 02 annual depreciation.

The depreciation of an asset is spread evenly across the life. Enter the purchase price of a business asset the likely sales price and how long you will use the asset to compute the annual rate of depreciation of that asset or piece of equipment. Depreciation remaining asset lifetime SYD x cost value salvage value Bear in mind that the SYD value is the sum of all useful life years.

Percentage Declining Balance Depreciation Calculator. The 1 buyout lease a capital lease in which the lessee makes fixed. 2022 is The Highest Deduction Ever for Section 179.

Item Age Years Replacement Cost 00. When an asset loses value by an annual percentage it is known as Declining Balance Depreciation. This makes the assumption that your heavy equipment will depreciate at the same rate every year of its useful life until it reaches its salvage value.

With our calculator you can choose from three of the most popular equipment lease types to calculate your payments. You can calculate the depreciation rate by dividing one by the number of years of useful lifean item with a useful life of five years. For example if you have an asset.

This depreciation calculator will determine the actual cash value of your Heavy Aluminum using a replacement value and a 20-year lifespan which equates to 02 annual depreciation.

Job Order Costing System Managerial Accounting Managerial Accounting Accounting Cost Accounting

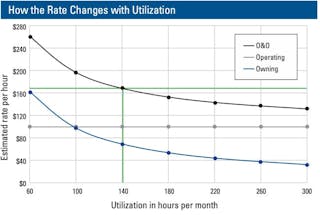

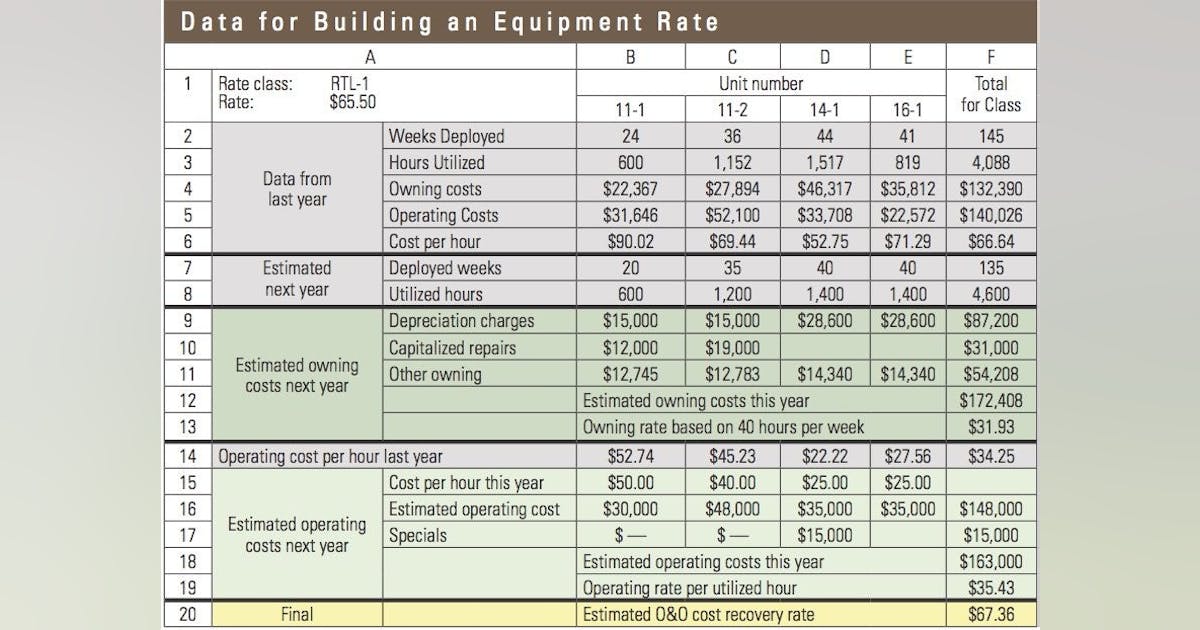

Time To Rethink The Equipment Rate Calculation Construction Equipment

Equipment Depreciation Basics And Its Role In Asset Management

Pin On Agricultural Machinery

Pin On Bussines Template Graphic Design

How Is The Depreciation Of Construction Equipment Calculated

Cash Flow Projection Template Flow Chart Template Cash Flow Cash Flow Statement

Calibrating Equipment Rates Construction Equipment

Accumulated Depreciation Overview How It Works Example

Financial Accounting Depreciation Calculation Fixed Assets Fixed Asset Financial Accounting Learn Accounting

7 Fishbone Diagram Templates Pdf Doc Diagram Excel Templates Templates Printable Free

Pin On Chart

What Is Equipment Depreciation And How To Calculate It

Time To Rethink The Equipment Rate Calculation Construction Equipment

Pin On Projects To Try

What Is Equipment Depreciation And How To Calculate It

Pp E Property Plant Equipment Overview Formula Examples